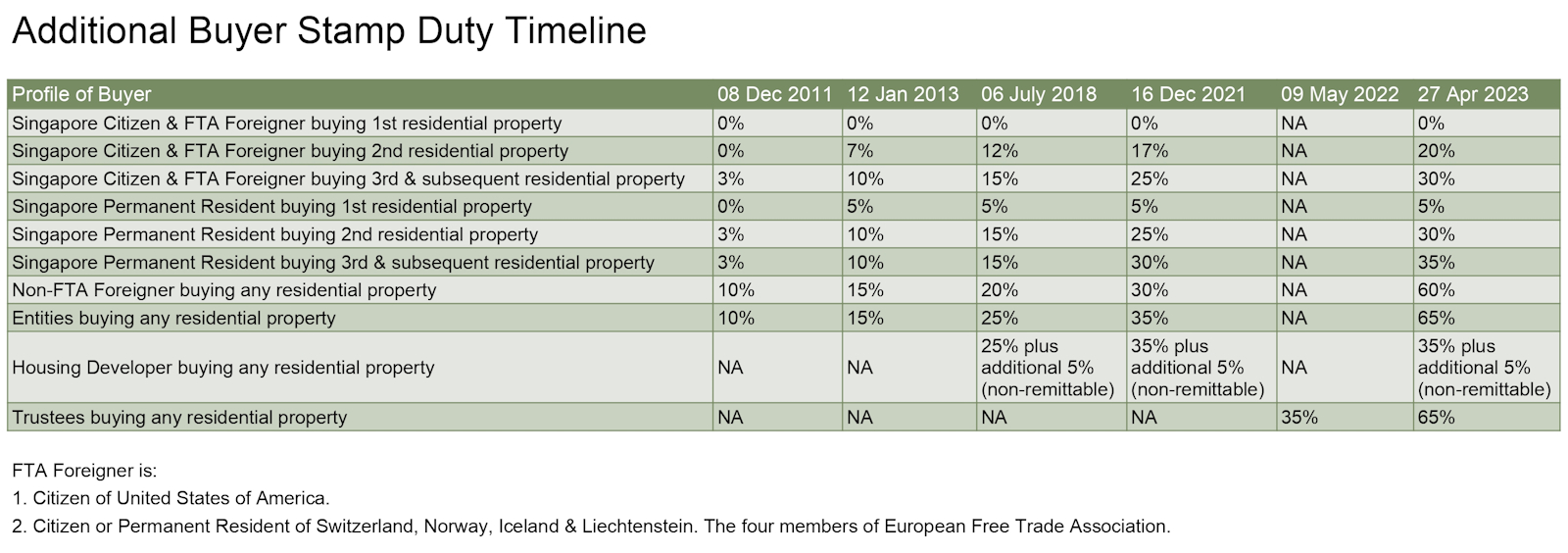

On 26 April 2023, the Government announced increases to the Additional Buyer’s Stamp Duty (ABSD) rates, which marks a third round of property cooling measures since December 2021. As stated in the Press Release jointly issued by the Ministry of Finance, the Ministry of National Development and the Monetary Authority of Singapore, the hike in the ABSD rates is meant to pre-emptively manage investment demand and prioritize housing for locals buying for owner-occupation. It is intended to work in tandem with an increase in housing supply by the government to address the problem of a tight housing market for owner-occupation and rental, with the goal of creating a more sustainable housing market in Singapore.

For the avoidance of doubt, the highest applicable ABSD rate will apply for acquisitions made jointly by two or more parties of different profiles. Buyers, particularly those intending to purchase property under a trust for their minor children, should note the increase in ABSD for Trustees from 35% to 65%. This increase may result in significant cash flow commitments, and also carries with it a potential risk given that the Inland Revenue Authority of Singapore may not approve the remission of ABSD (Trust).

Transitional ABSD Remission (FYI)

There will be a transitional period where ABSD Rates on or before 26 April 2023 will apply, and ABSD remission can be granted. To qualify for this transitional ABSD remission however, the following conditions have to be met:

- The Option to Purchase (OTP) was granted by sellers to potential buyers on or before 26 April 2023

- This OTP is exercised on or before 17 May 2023, or within the OTP validity period, whichever is earlier; and

- This OTP has not been varied on or after 27 April 2023.

To apply for the remission, an application has to be submitted to the Inland Revenue Authority of Singapore within 14 days after the date of execution of the instrument.

Avoid ABSD by Buying Dualkey Unit

Dualkey units refer to a type of property unit that consists of two separate living spaces, each with its own entrance and often connected by a common foyer or hallway. These units typically contain two separate bedrooms, bathrooms, and kitchens, making them ideal for couples or families who want to live together while still enjoying some level of privacy. It is worth noting that dualkey units are becoming an increasingly popular housing option in the city-state, particularly among younger couples or families looking to purchase their first home.

The benefits of dualkey units are numerous. For starters, they can provide a cost-effective means of housing two separate families or individuals in a single unit, which can be especially useful in high-cost urban areas like Singapore. They also offer excellent flexibility in terms of how the space can be used; for example, one unit could be rented out to generate income while the other is used as a primary residence. Additionally, dualkey units are often seen as an attractive investment opportunity, as they tend to retain their value well over time.

However, there are also some potential drawbacks to dualkey units. First and foremost, they may not be suitable for every living situation, as they can be relatively small and may not provide enough living space for larger families or those who require more room to spread out. Additionally, because dualkey units often contain multiple tenants, there can be some added complexity when it comes to managing maintenance or tenant issues.

Buy Commercial or Industrial Properties

Commercial properties are properties that are used for business purposes, such as offices, retail spaces, hotels, and other service-oriented premises. They are usually located in prime areas with high human traffic and accessibility. They tend to have higher rental yields and capital appreciation than residential properties, but they also have higher maintenance costs and vacancy risks. Commercial properties are subject to Goods and Services Tax (GST), which is currently 8% from 01 January 2023.

Industrial properties are properties that are used for manufacturing, storage, logistics, and other industrial activities. They are usually located in designated industrial zones with lower land prices and rents. They tend to have lower rental yields and capital appreciation than commercial properties, but they also have lower maintenance costs and vacancy risks. Industrial properties are not subject to GST, unless they are used for non-industrial purposes.

Additional Buyer’s Stamp Duty (ABSD) is a tax imposed on buyers of residential properties in Singapore, depending on their citizenship and the number of properties they own. ABSD does not apply to commercial or industrial properties. Therefore, buying commercial or industrial properties in Singapore can have some benefits and drawbacks compared to buying residential properties.

Some of the benefits are:

- No ABSD for commercial or industrial properties.

- Higher rental yields and capital appreciation potential for commercial properties in prime locations.

- Lower land prices and rents for industrial properties in designated zones.

- Diversification of investment portfolio and exposure to different market segments.

Some of the drawbacks are:

- GST payable for commercial properties.

- Higher maintenance costs and vacancy risks for commercial properties.

- Lower rental yields and capital appreciation potential for industrial properties in less accessible locations.

- Higher entry barriers and stricter regulations for foreign buyers of commercial or industrial properties.

Upgrade to Executive Condominium

An annoying thing about ABSD is that, even if you’re just upgrading with no intention to own two properties, you still need to pay the ABSD upfront (you then proceed to apply for remission if you sell your previous home within six months of getting the key to your new home, one year will be better, more time to sell current home).

This means you still need to fork out the hefty 20% tax (30% for Permanent Residents) in cash or CPF.

But the good news is this only applies to private condos. If you purchase a new Executive Condominium (EC), you don’t need to pay the ABSD upfront. You do still need to dispose of your flat within six months of course, but at least you won’t be faced with needing more cash or CPF savings upfront.

Buying of Executive Condominium is subjected to strict criteria.

Purchase under a Trust (need lots of cash in hand)

This involves buying the property under trust for your child. Requires the service of conveyancing lawyer to do this. Property purchased needs to be paid in full, ABSD at 65% as of 27 April 2023 needs to be paid in full, no bank loan allowed.

It is now crucial to ensure that your conveyancing lawyer drafts the trust document in a manner that fulfils the ABSD remission conditions. If not, it may result in failure in remission application, you could forfeit a huge amount of cash.

Bear in mind if your child were to take possession of the private property, he/she or with spouse can’t then apply for a HDB flat while owning it. And of course, they’d be subjected to ABSD if they try to get another private property for him/herself.

Conditions for remission: Link

1. The residential property is held on trust for identifiable individual beneficiaries only.

2. ABSD (Trust) of 65% has been paid.

3. The application is made within 6 months after the date of execution of the instrument.

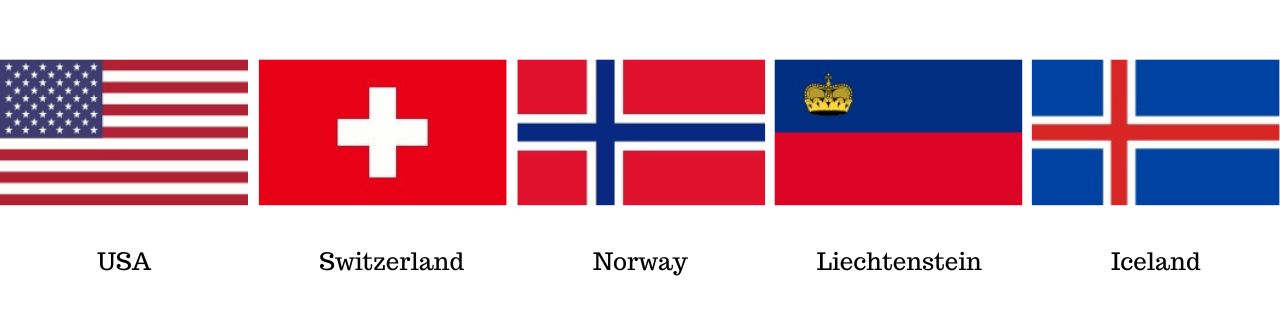

Nationals from countries with Free Trade Agreements with Singapore.

Under the respective Free Trade Agreements (FTAs), Citizens and Permanent Residents of Iceland, Liechtenstein, Norway and Switzerland, and Citizens of the United States of America, are accorded the same Stamp Duty treatment as Singapore Citizens.

Switzerland, Liechtenstein, Norway and Iceland are the four members of European Free Trade Association. Link to the Free Trade Agreement effective 01 January 2003.

Link to Singapore-USA Free Trade Agreement effective 01 January 2004.

This means such foreigners will only have to pay the Buyer Stamp Duty when they purchase their first home in Singapore and do not need to pay any ABSD. This is even better than the treatment of Singapore Permanent Residents when buying a residential properties in Singapore.

Sell One, Buy Two

The Sell One, Buy Two real estate strategy is a popular investment approach in Singapore, where investors sell their current property and use the profits to purchase two. E.g. sell HDB and use proceeds as downpayment for two private condos. This strategy provides a number of benefits, including diversification of investments and potentially higher returns. However, it also carries some risks, so investors should be aware of these before making a decision.

One of the biggest advantages of the Sell One, Buy Two strategy is diversification. By splitting the proceeds of the sale of a single property into two separate acquisitions, investors are able to spread their risk across multiple properties and geographical areas. This helps to reduce the impact of fluctuations in the market, as the returns from each property are less likely to be affected by the same factors.

The strategy also offers potential for higher returns. By buying two smaller properties instead of one larger one, investors can take advantage of lower prices per square foot and potentially higher rental yields. This can be especially beneficial in areas with higher demand for rental properties, as the investor can charge a higher rate for their units than they would with a single larger property.

The Sell One, Buy Two strategy also has some potential risks, however. One of the main risks is the cost of financing two separate properties. Investors may find themselves with higher monthly payments and increased interest expense if they choose to finance both purchases. Additionally, the properties may not appreciate in value at the same rate, so investors may find themselves with an uneven return on their investment.

Finally, there is the risk of over-leveraging. If an investor decides to purchase two properties with the proceeds of the sale of one, they may find themselves with a higher loan-to-value ratio and a higher debt burden. This could lead to difficulty in making payments if the properties do not generate the expected rental income or if the market changes.

Overall, the Sell One, Buy Two strategy can be a powerful way for investors to maximize their returns, diversify their investments, and spread their risk.

Decoupling

Decoupling has been a hot topic in Singapore’s real estate market for quite some time. Property holders have been lured by its potential benefits, such as increased financial flexibility and tax savings. But, as with anything, there are risks involved too. So, let’s dive into the world of decoupling and uncover its long-term implications for Singapore’s property market.

Decoupling, in the context of Singapore’s real estate, refers to the process of separating the ownership of a property between two or more co-owners. This is typically done to avoid the Additional Buyer’s Stamp Duty (ABSD) and reduce property taxes. For instance, if a married couple jointly owns a property, they can choose to transfer 100% ownership to one spouse, thus allowing the other spouse to purchase another property without incurring ABSD.

Before we weigh the risks, let’s first explore some of the potential benefits of decoupling:

- Financial flexibility: Decoupling allows property owners to take advantage of financial opportunities. By transferring ownership to one spouse, the other can invest in a new property without incurring additional taxes.

- Tax savings: Decoupling can lead to substantial savings on property taxes. For instance, if a couple transfers 100% ownership of their property to one spouse, they can avoid the hefty 20% to 30% ABSD when purchasing another property.

- Asset diversification: Decoupling can enable property owners to diversify their investment portfolio by allowing them to invest in multiple properties.

Despite its potential benefits, decoupling carries certain risks that property owners should be aware of:

- Legal fees and stamp duties: Decoupling involves the transfer of property ownership, which requires the payment of legal fees and stamp duties. These costs can be substantial and may offset the potential tax savings from decoupling.

- Financial implications: In the event of a divorce or separation, decoupling can have significant financial implications. The spouse who transfers their share of the property may lose out on any future appreciation in value.

- Risk of default: Decoupling often involves refinancing the property, which can expose the remaining owner to the risk of default if they are unable to meet the new mortgage repayments.

Single Owner Essential Occupier Scheme

If you are a Singaporean who owns a HDB flat and wants to buy a private property, you might be deterred by the hefty Additional Buyers Stamp Duty (ABSD) that you have to pay. ABSD is a tax imposed on second or subsequent residential property purchases, and it can range from 20% to 30% depending on your residential status and the number of properties you own.

But what if we told you that there is a way to avoid paying ABSD legally, by using a scheme called the Single Owner Essential Occupier Scheme!

The Single Owner Essential Occupier Scheme is a way of buying a HDB flat with only one person listed as the owner (or sole lessee), and the other person listed as an essential occupier. An essential occupier is someone who helps you meet the eligibility criteria for buying a HDB flat, such as your spouse, fiancé, parent, child, or sibling.

By using this scheme, you can avoid paying ABSD on your second property purchase, as long as the essential occupier does not own any other property locally or overseas, and has not disposed of any within the last 30 months. This is because under the eyes of the law, the essential occupier is not a home owner.

To use this scheme, you have to apply for a new or resale HDB flat with one person as the single owner and the other person as the essential occupier. You also have to ensure that both of you do not own any other property at the time of application.

After you buy the HDB flat, you have to fulfil the Minimum Occupation Period (MOP) of five years before you can sell it or buy another property. During this period, you have to live in the flat with your essential occupier.

Once you complete the MOP, you can then buy a private property under the name of the essential occupier, who will be considered as a first-time property buyer and not subject to ABSD. You can then either sell your HDB flat or keep it as an investment property.

The main benefit of using this scheme is that you can save a lot of money on ABSD when buying a private property. For example, if you are a Singapore citizen and you buy a private property worth one million under your name after owning a HDB flat, you have to pay 20% ABSD, which amounts to $200,000. But if you buy it under your spouse’s name who is an essential occupier of your HDB flat, she doesn’t has to pay ABSD at all.

Another benefit is that you can diversify your property portfolio by owning both a HDB flat and a private property. This can give you more options for rental income, capital appreciation, or retirement planning.

The main drawback of using this scheme is that it involves some risks and trade-offs. For instance:

- You have to wait for five years before you can buy a private property under the essential occupier’s name. This means that you might miss out on some good opportunities in the market during this period.

- You have to share the ownership of your HDB flat with your essential occupier. This means that you have less control over the property and its disposal. If you want to sell it or refinance it, you need the consent of your essential occupier. If you divorce or separate from your spouse who is an essential occupier, you might face some complications in dividing the property.

- You have to live in your HDB flat with your essential occupier for five years. This means that you have less flexibility and privacy in your living arrangements. If you want to move out or rent out your HDB flat, you need to seek approval from HDB.

- You have to abide by the rules and regulations of HDB. This means that you have to comply with the ethnic quota, income ceiling, occupancy cap, and other restrictions imposed by HDB on your flat.

The Single Owner Essential Occupier Scheme is not for everyone. It depends on your personal situation and preferences. Before you decide to use this scheme, you should consider the following factors:

- Your financial goals and budget. Do you want to save on ABSD or are you willing to pay for it? How much can you afford to spend on your second property? How much do you expect to earn from your properties?

- Your relationship status and stability. Are you married or engaged to your essential occupier? How confident are you that your relationship will last? How do you plan to handle any disputes or changes in your relationship?

- Your lifestyle and preferences. Do you like living in a HDB flat or a private property? How important is privacy.

Amalgamation

Are you a property investor in Singapore who owns multiple residential properties and wants to optimize your portfolio and save ABSD? If so, you may want to consider amalgamation, a strategy that allows you to combine two or more adjacent/adjoining properties into one larger property, and potentially reduce your ABSD liability. Amalgamation is typically beyond the reach of ordinary folks, reserved mainly for high networth individual. In this short section, let me explain how amalgamation works, its benefits and drawbacks.

What is Amalgamation?

Amalgamation is a property investment strategy that involves combining two or more adjacent/adjoining properties into one larger property, typically by removing or modifying the walls or boundaries between them. Amalgamation can be applied to both Housing and Development Board (HDB) flats (aka Jumbo unit) and private properties, subject to certain rules and regulations. Amalgamation can result in a larger and more valuable property with improved layout, space, and functionality, as well as potential cost savings and benefits.

How Can Amalgamation Help You Save ABSD?

If you are a Singaporean, FTA Foreigner or Permanent Resident who already owns one or more residential properties in Singapore and is buying another property, you may be subject to Additional Buyer’s Stamp Duty (ABSD), which is a tax levied on the purchase price or market value of the property. The ABSD rates vary depending on your citizenship, residency status, and the number of properties you own. For example, if you are a Singaporean buying a second residential property, you have to pay ABSD of 20% on the purchase price.

However, if you apply for amalgamation and combine your existing properties or buy new properties, you may be able to reduce your ABSD liability or avoid it altogether. The Inland Revenue Authority of Singapore (IRAS) has guidelines on how to calculate ABSD for amalgamated properties, which take into account the number of properties involved, the ownership structure, and the market value of the properties before and after amalgamation. In some cases, the ABSD liability for amalgamated properties may be lower than the total ABSD for the individual properties, resulting in cost savings.

What are the benefits and drawbacks of Amalgamation?

Amalgamation can provide several benefits for property investors in Singapore, including:

- Larger and more valuable property: By combining two or more adjacent properties, you can create a larger and more valuable property with improved layout, space, and functionality, which can enhance your living or investment experience.

- Potential cost savings: By reducing your ABSD liability or avoiding it altogether, amalgamation can result in significant cost savings, especially if you are buying an expensive property and the ABSD amount is substantial.

- Optimized property portfolio: By consolidating your properties into one or a few amalgamated properties, you can streamline your portfolio management, reduce your maintenance and transaction costs, and potentially achieve higher rental or resale yields.

However, amalgamation also has some drawbacks to consider, including:

- Complex process: Amalgamation involves various legal, technical, and practical considerations, such as obtaining the necessary approvals from the relevant authorities, complying with the building and fire safety codes, and coordinating with the neighbouring owners and tenants. The process can be time-consuming, costly, and risky if not handled properly.

- Limited eligibility: Amalgamation is only available to adjacent properties that meet the eligibility criteria, such as having common walls, doors, or staircases, and being owned by the same person or entity. If your properties do not meet these criteria, you may not be able to apply for amalgamation.

- Potential impact on resale value: Amalgamation may affect the resale value of your property, as potential buyers mayprefer properties without amalgamation or may be limited by the market demand for larger properties. Therefore, you should carefully consider the potential impact on your future resale prospects before proceeding with amalgamation.

- Potential renovation and maintenance costs: Amalgamation may require extensive renovation and maintenance works, such as plumbing, electrical, and structural changes, which can incur additional costs and risks. You should ensure that you have sufficient funds and resources to undertake these works and comply with the relevant regulations and standards.

How to Apply for Amalgamation?

If you are interested in applying for amalgamation, you can follow these steps:

- Check the eligibility criteria and regulations for amalgamation, which may differ for HDB flats and private properties, and for different types of ownership structures.

- Engage a qualified and experienced licensed real estate salesperson who can advise you on the technical and legal aspects of amalgamation, and help you to prepare the necessary documents and applications.

- Obtain the necessary approvals from the relevant authorities, such as the Housing Development Board (HDB), the Urban Redevelopment Authority (URA), Strata Title Board (STB), the Building and Construction Authority (BCA) to comply with the building and fire safety codes and the Management Corporation Strata Title (MCST ).

- Coordinate with the neighbouring owners and tenants, and ensure that the amalgamation works do not affect their rights and interests, and are carried out in a safe and professional manner.

- Monitor the progress and quality of the amalgamation works, and address any issues or defects promptly.

In conclusion, amalgamation can be an effective strategy for property investors in Singapore to optimize their portfolio and save ABSD. By combining two or more adjacent properties into one larger property, they can create a more valuable and functional property, reduce their ABSD liability, and potentially achieve higher rental or resale yields. However, amalgamation also has some challenges and risks, such as the complex process, limited eligibility, potential impact on resale value, and renovation and maintenance costs. Therefore, if you are considering amalgamation, you should seek professional advice, carefully weigh the benefits and drawbacks, and ensure that you comply with the relevant regulations and standards. With the right approach, amalgamation can help you to achieve your property goals and maximize your returns in Singapore’s dynamic real estate market.

In Conclusion

In my opinion, ABSD is here to stay. Together with others property cooling measures, they’re now part of property buying/investing psyche in Singapore. Government will probably revise ABSD upwards if demand remains stubbornly strong. This article presents a few options available on how to avoid ABSD legally to whom it may concern. Policy changes all the time, but you as buyer or investor, as long as you are in the market, need to stay updated about market, products and policies against the backdrop of your personal aspirations, finances, constraints and circumstances. I’m Kenn Chin, if I can be of any help in your real estate matters, do reach out.