In Singapore, the majority of properties are leasehold, which means that buyers actually purchase the right to use the property for a fixed period of time, typically 99 years. At the end of the leasehold period, ownership of the property reverts back to the state. In contrast, freehold properties are owned outright by the owner and are not subject to any leasehold agreements.

One of the key differences between leasehold and freehold properties in Singapore is the length of ownership and control over the property. With a freehold property, the owner has indefinite ownership and control over the property. This means that freehold properties are generally considered more valuable than leasehold properties.

In contrast, the owner of a leasehold property has a finite period of ownership, and is subject to certain restrictions and conditions specified in the lease agreement. For example, the owner of a leasehold property may be restricted in terms of alterations to the property, subletting, or sale of the property. While the owner of a leasehold property has the right to use and occupy the property during the lease period, they do not have full control over the property.

Another important difference between leasehold and freehold properties in Singapore is their relative prices. Leasehold properties are generally less expensive than freehold properties, reflecting the fact that the former have a limited period of ownership. However, as the leasehold period approaches its end, the value of the property may decline, potentially making it more difficult to sell. On the other hand, freehold properties are generally more expensive, but may be more attractive to buyers due to the indefinite ownership and control over the property.

Lease Decay

Lease Decay refers to the gradual reduction in the remaining lease term of a leasehold property. In Singapore, most leasehold properties have a lease term of either 99 or 999 years, which means that they will eventually revert back to the government once their lease expires.

Lease decay occurs because the lease term is finite, and the property value tends to decline as the lease term approaches its end. This is because the value of a leasehold property is directly linked to the remaining lease term. As the remaining lease term decreases, the value of the property also decreases, making it less attractive to potential buyers.

As the lease decay continues, the value of the property may continue to decline, making it more difficult to sell or refinance. Additionally, if the remaining lease term falls below a certain threshold, typically around 30 years, it may become difficult or impossible to obtain a mortgage to purchase the property.

Lease decay is an important consideration for anyone looking to purchase a leasehold property in Singapore. It is important to understand how the remaining lease termaffects the value of the property and to consider the potential implications of lease decay over the long term. Buyers should also be aware that leasehold properties with shorter remaining lease terms may be subject to more stringent restrictions on renovations and other changes, which can further impact the property’s value.

To mitigate the impact of lease decay, buyers may consider purchasing a property with a longer remaining lease term. Another option is to look for leasehold properties that are located in areas with strong demand and limited supply, which can help to maintain or even increase the property’s value despite lease decay. Ultimately, it is essential for buyers to do their due diligence and carefully evaluate the potential risks and benefits of purchasing a leasehold property in Singapore. This will lead us to Bala’s Curve.

Bala’s Curve

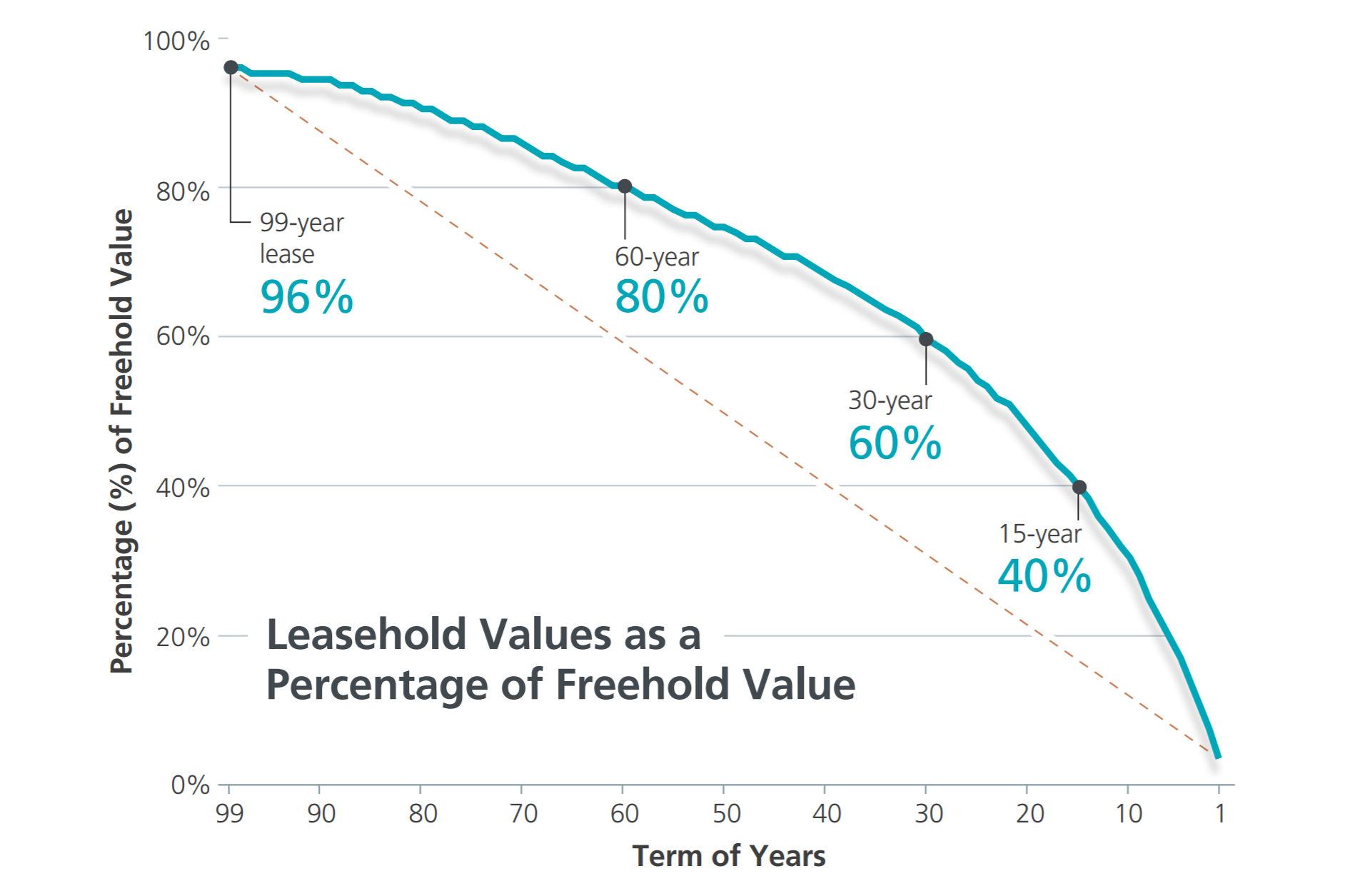

Bala’s Curve describes the relationship between a leasehold property’s remaining lease term and its value over time with property values decreasing as the remaining lease term approaches its midpoint, and then declining as the lease term approaches its end.

The curve is named after Mr. Bala Subramaniam , a Singaporean property valuer with Land Office who first observed this pattern circa 1948. He found that leasehold properties tended to experience a peak in value when they had around 60 years remaining on the lease, after which the value gradually declined as the remaining lease term decreased.

The reason for this pattern is that buyers are willing to pay a premium for a leasehold property with a longer remaining lease term, as it provides them with a longer period of ownership and reduces the risk of the property reverting back to the government. However, as the remaining lease term decreases, the risk of the property reverting back to the government increases, and buyers become less willing to pay a premium for the property.

So, if you’re thinking about purchasing a leasehold property in Singapore, it’s important to keep Bala’s Curve in mind. Properties with longer remaining lease terms may be more valuable, but they may also be more expensive. Properties with shorter remaining lease terms may be more affordable, but they may also be subject to more restrictions and have a shorter remaining lifespan.

It’s also worth noting that the curve is not always a perfect and the peak value and decline in value may occur at different points depending on market conditions and other factors. However, Bala’s curve can still be a useful tool for understanding the relationship between leasehold property values and remaining lease terms.

Factors that can affect Bala’s Curve!

While Bala’s Curve generally describes the relationship between a leasehold property’s remaining lease term and its value over time, there are a number of factors that can affect the shape of the curve. Here are a few examples:

- Location: The location of the property can have a significant impact on its value, and this can affect the shape of Bala’s curve. For example, a leasehold property located in a prime area may retain its value for a longer period of time, while a property in a less desirable location may see its value decline more quickly as the lease term approaches its end.

- Market Conditions: Market conditions can also affect the shape of Bala’s curve. In a strong market, buyers may be willing to pay a premium for a leasehold property with a shorter remaining lease term, while in a weaker market, buyers may be more cautious and prefer properties with longer remaining lease terms.

- Property Condition: The condition of the property can also impact its value and the shape of Bala’s curve. A property that has been well-maintained and is in good condition may retain its value for a longer period of time, while a property that is in poor condition may see its value decline more quickly as the lease term approaches its end.

- Government Policies: The government’s policies on leasehold properties can also affect the shape of Bala’s curve. For example, if the government announces plans to renew or extend leasehold properties, this may increase the value of leasehold properties with shorter remaining lease terms, and flatten or shift the peak of the curve to the right. Conversely, if the government announces plans to acquire leasehold properties upon expiry, this may accelerate the decline in value of leasehold properties with shorter remaining lease terms, and make the curve steeper.

- Demand and Supply: The demand and supply of leasehold properties can also impact the shape of Bala’s curve. If there is a high demand for leasehold properties with longer remaining lease terms, this may increase their value and shift the peak of the curve to the left. Conversely, if there is a surplus of leasehold properties with shorter remaining lease terms, this may decrease their value and make the curve steeper.

Sidenote: The Adoption of Bala’s Curve in HDB’s Lease Buyback Scheme

HDB has a “Lease Buyback Scheme” (LBS) that allows the elderly to sell part of their HDB remaining lease back to HDB in exchange for cash proceeds for the elderly to tide over their remaining days. HDB valuers will use the Bala’s Table to determine the value of the HDB flat to compensate the elderly.

However, HDB will normally offer higher sales proceed to compensate the elderly for those who choose to take up the HDB Lease Buyback Scheme that comes with certain terms and conditions. That is, those who take up the scheme will not be able to rent out the entire unit nor sell on the open market. In case they wish to sell the property, they have to sell back to HDB where HDB will apply the same thing, determine the value of the HDB flat based on Bala’s Table to compensate back the homeowners.

Leasehold Table

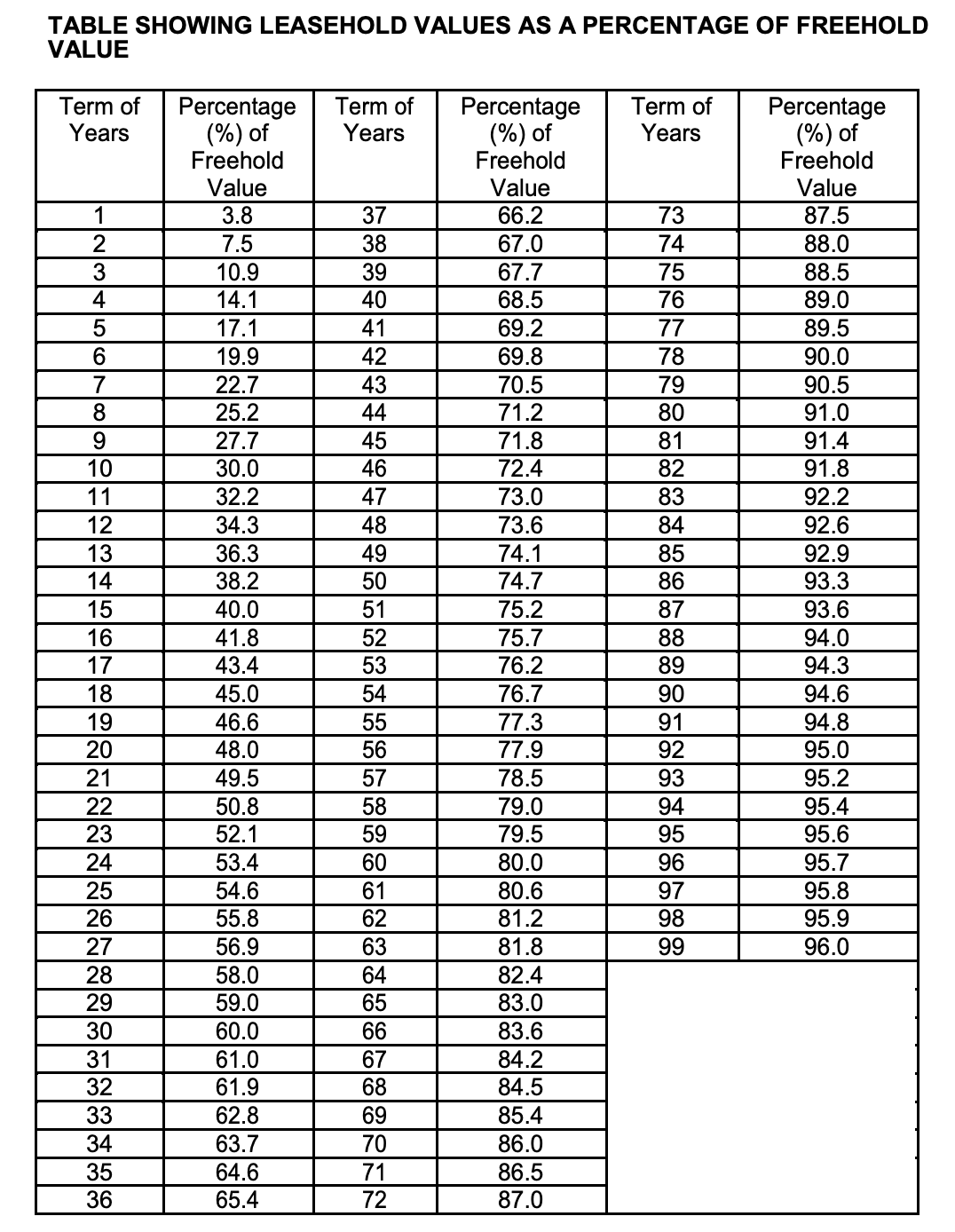

Serving as a guideline, Bala’s Curve is used by Singapore Land Authority to produce The Leasehold Table.

Bala’s Curve suggests that there is an optimal leasehold period that will maximize the return on investment. The idea is that if the leasehold period is too short, the property may not be attractive to buyers and may not appreciate in value over time. On the other hand, if the leasehold period is too long, the property may be too expensive to purchase, and the risk of the property being devalued over time may increase.

When using the Leasehold Table to analyze a leasehold property, it is important to take into account the optimal leasehold period suggested by Bala’s Curve. This can help investors to determine the appropriate length of leasehold period to consider when evaluating the potential returns of a given property.

By taking into account both the Leasehold Table and Bala’s Curve, investors can make more informed decisions about whether to invest in a particular leasehold property, and for how long. For example, an investor may use the Leasehold Table to project cash flows and returns under different leasehold scenarios. They can then compare these projections to the optimal leasehold period suggested by Bala’s Curve, and select the option that offers the best balance of risk and return.

Why Leasehold Table Matters to Developers

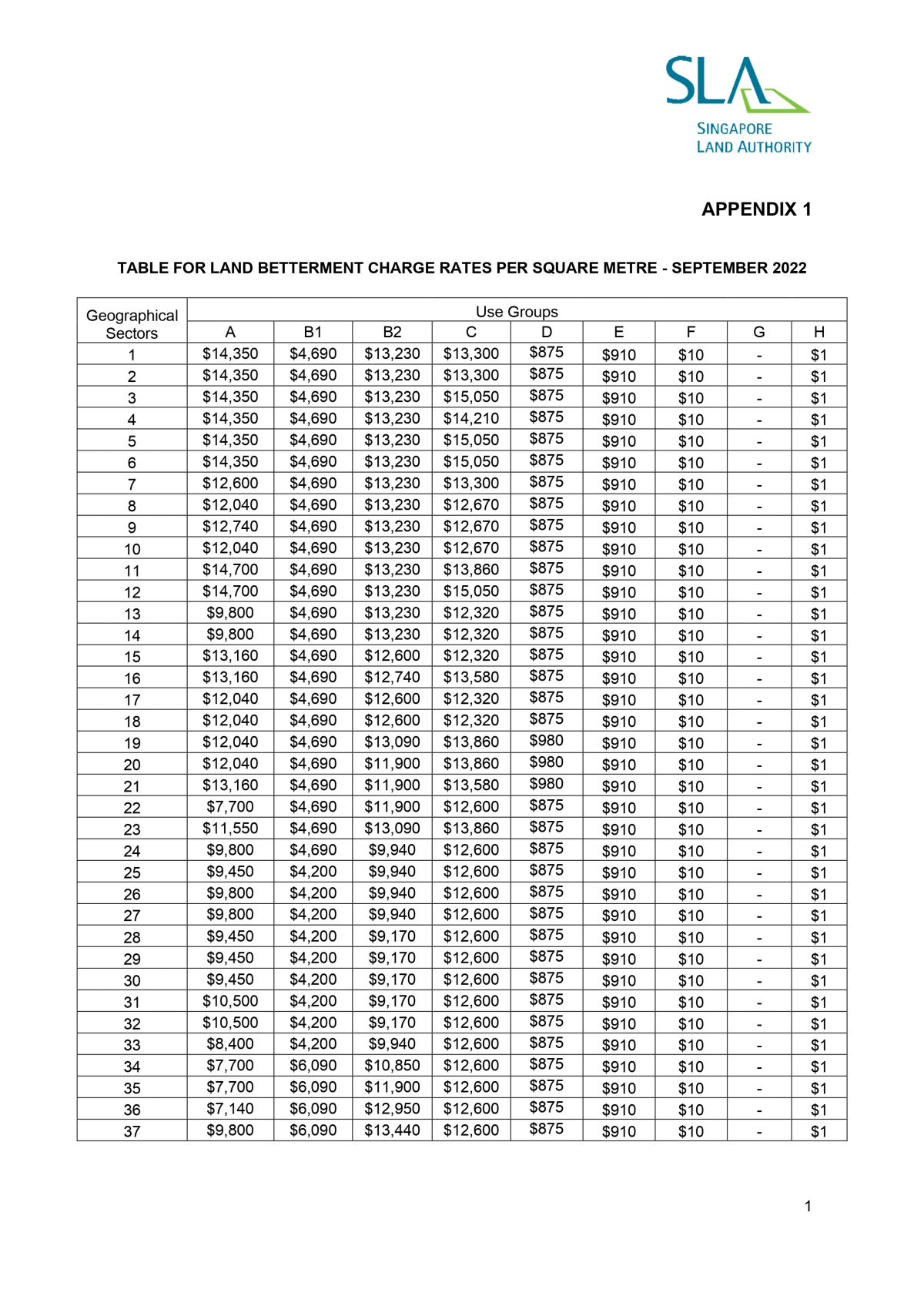

Developers are required to pay Differential Premium (DP) or Development Charge (DC) for the enhancement of land use or increase in land value and Upgrading Premium (UP) for the extension of leasehold land tenures. The amount of DP, DC or UP payable to the state is highly dependent on the values indicated in the table, and these payments can range from hundreds of millions to billions of dollars.

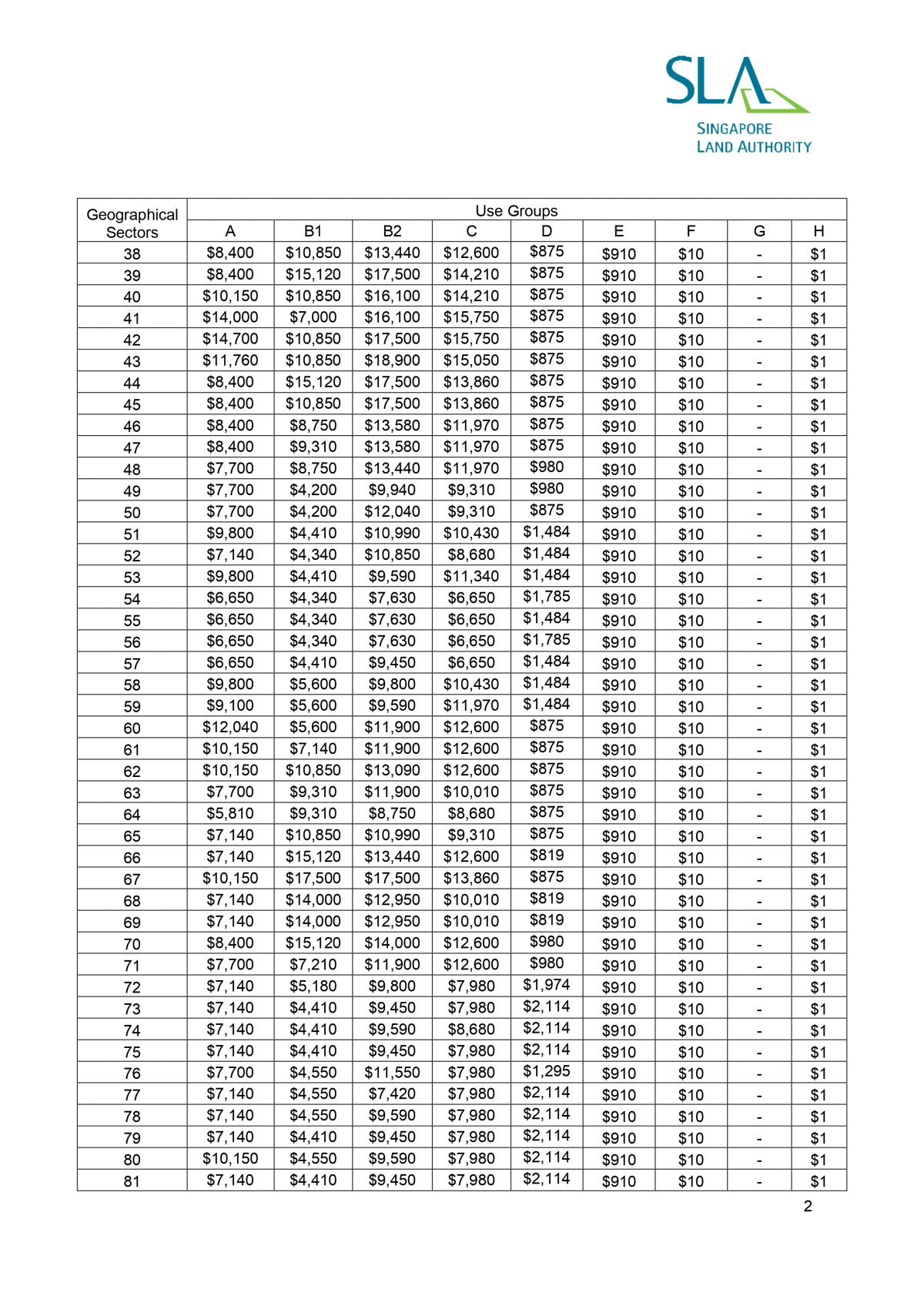

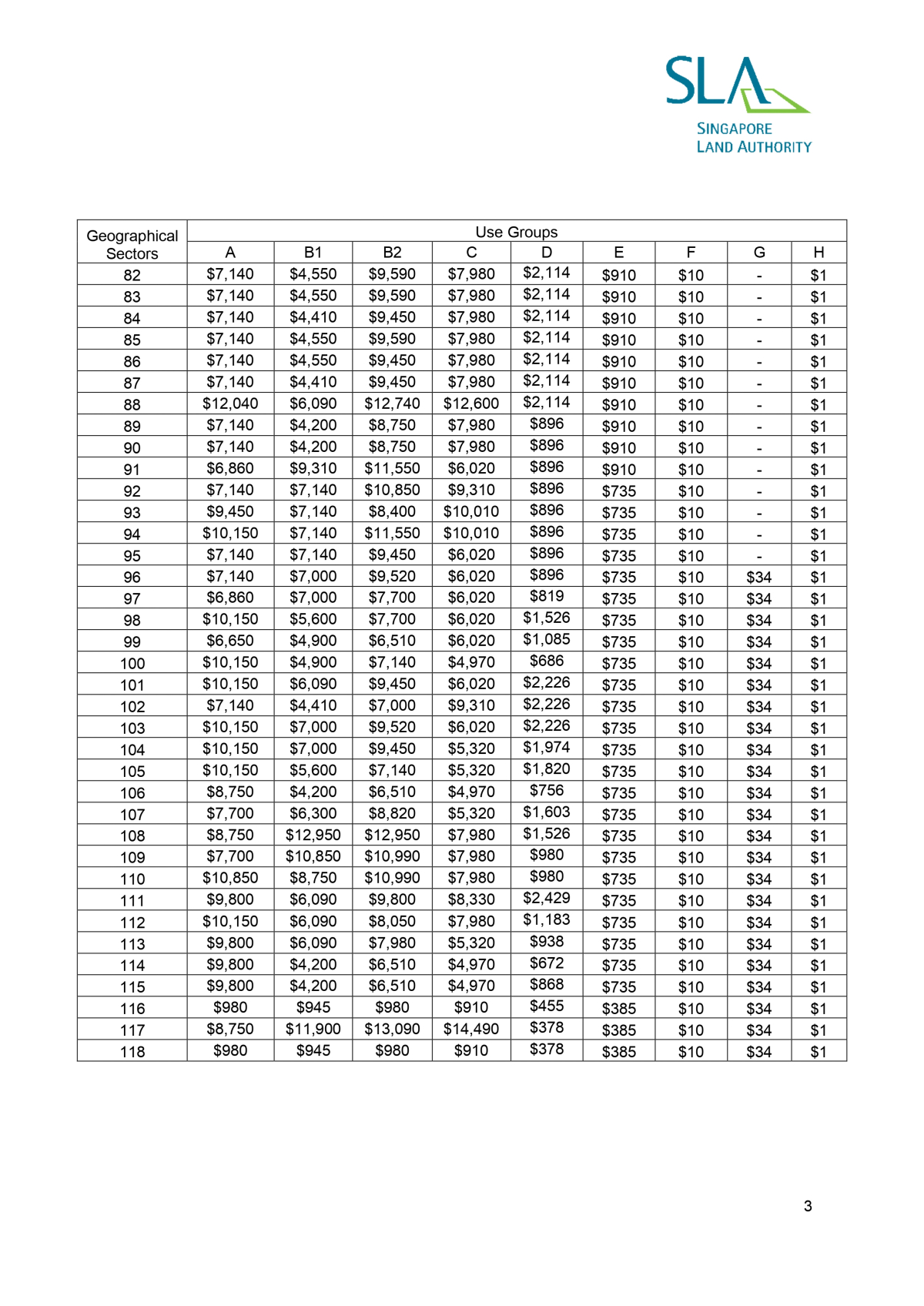

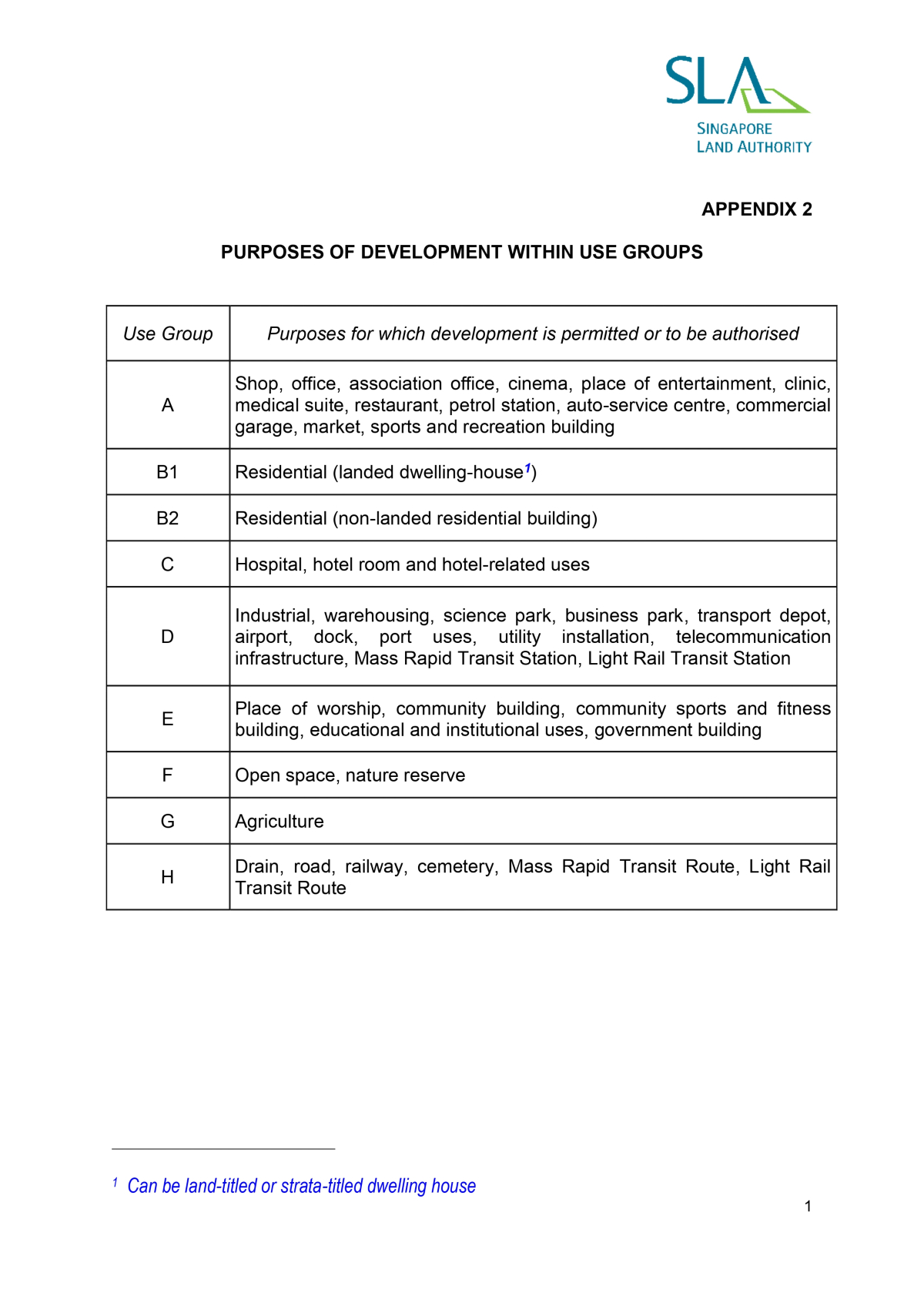

Effective from 01 August 2022, a new Land Betterment Charge (LBC) will replace DP and DC. LBC will be charged and collected by a single agency, Singapore Land Authority, pursuant to the Land Betterment Charge Act 2021. The LBC rates are reviewed and revised every six months. The exact rates payable depend on the Sector of Singapore in which the property is located, as well as the Property Type and Use Group. It is charged on a per square meter basis.

The hike in LBC means that the total cost of developing land is going to rise since developers are going to have to pay a higher tax on the increase in the value of the land. Examples include enhancing an existing development (such as by building a new annexe) and redeveloping existing land to build a bigger property (such as in the case of an enbloc sale). The effects of LBC may include fewer enbloc sales, higher cost of land and higher private home prices.

URA SPACE LAND BETTERMENT CHARGE RATE BY SECTOR

In Conclusion

The difference between leasehold and freehold properties in Singapore lies in the length of ownership and control over the property. While freehold properties offer the owner indefinite ownership, leasehold properties are owned for a fixed period of time. The relative prices of leasehold and freehold properties are also different, with leasehold properties being generally less expensive but potentially declining in value as the lease period approaches its end. Ultimately, whether to invest in leasehold or freehold properties depends on factors such as an investor’s risk appetite, investment goals, and prevailing market conditions. It is important to conduct thorough research and analysis before making any investment decisions, and to consult with a professional advisor if necessary.